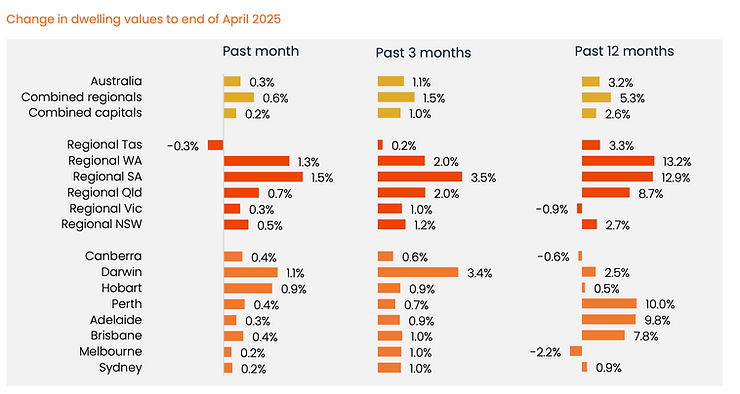

The Australian property market continues its upward trajectory, but the latest data reveals a subtle shift in momentum. According to the most recent figures from April 2025, national home values experienced a further 0.3% increase, adding approximately $2,720 to the average dwelling. While any growth is noteworthy, a closer look reveals a market in transition.

Slower Pace, Persistent Growth:

The initial boost from the Reserve Bank of Australia’s (RBA) February rate cut appears to be losing some steam. While prices are still climbing, the pace has eased compared to the more robust gains seen earlier in the year. This moderation is further underscored by the annual growth rate, which has slowed to 3.2% in April, the lowest annual increase since August 2023.

Several factors are contributing to this nuanced picture. A dip in household confidence during April, potentially influenced by international trade discussions and the looming federal election, has introduced an element of uncertainty into the market. This hesitancy may be contributing to the notably low number of new properties listed for sale in April, reaching the lowest point for this time of year since 2019 (excluding the initial pandemic period). Consequently, auction clearance rates have also seen a slight adjustment, averaging around 60%, suggesting a cooling in buyer competition.

Capital City Contrasts:

Data and insights referenced from the CoreLogic Hedonic Home Value Index Report, April 2025.

Despite the national trend of moderating growth, individual capital cities present a varied landscape. All capital cities recorded price increases in April, highlighting the underlying resilience of the market. However, the magnitude of growth differed significantly:

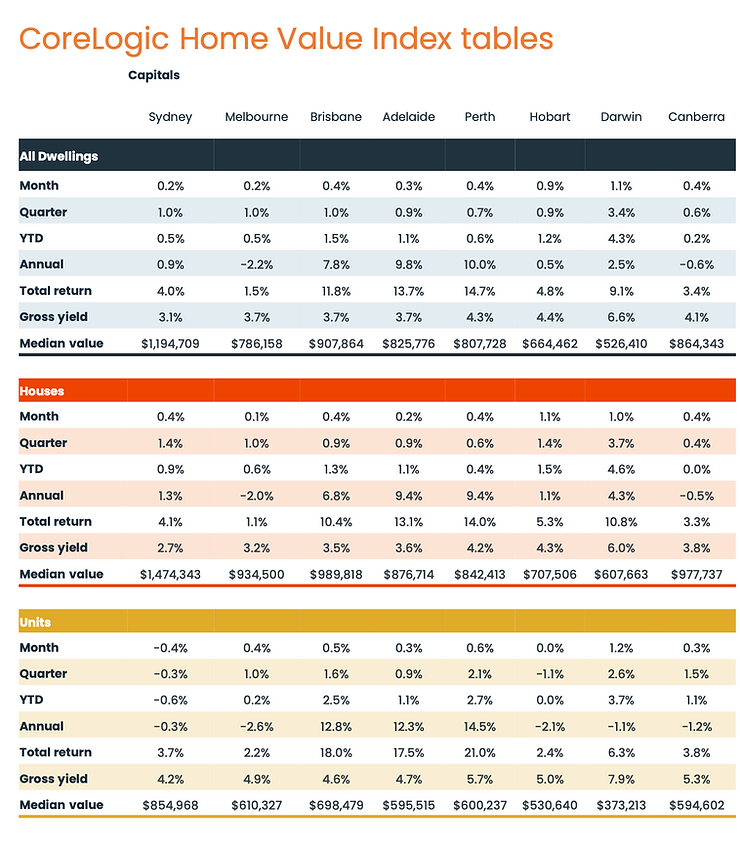

- Sydney and Melbourne: These major markets saw modest increases of 0.2%. Interestingly, their values remain below their recent peaks, indicating a more cautious recovery.

- Brisbane and Perth: Continuing their strong performance from the past year, these cities experienced slightly stronger growth at 0.4% in April.

- Adelaide: This market continues its impressive run, recording a 0.3% increase and achieving a significant milestone with its median house price now exceeding $1 million.

- Hobart and Darwin: These cities registered the most substantial gains in April, with increases of 0.9% and 1.1% respectively. However, Hobart’s values are still significantly below their previous peak.

- Canberra: Prices in the nation’s capital rose by 0.2% but remain below their earlier high.

Key Market Dynamics

Interest Rates and Consumer Confidence: February’s interest rate cuts initially boosted market conditions; however, their impact began to diminish by April. Global economic uncertainties and domestic political concerns around the federal election notably impacted consumer confidence, causing caution among buyers and sellers.

Auction and Listings: Auction volumes dropped significantly to the lowest levels for an Easter week since 2019, with just 644 auctions recorded across combined capitals. New listings also fell sharply, with only 19,650 listings across capital cities in April, indicating hesitation among market participants. Despite lower transaction volumes, persistent undersupply continued to underpin rising values.

Houses vs. Units Analysis

Detached homes significantly outperformed units, particularly in Sydney, where house values rose by 1.4% quarterly against a 0.3% decline in unit values. This divergence illustrates a persistent preference for more spacious and independent living arrangements post-pandemic.

Regional markets, boosted by affordability and lifestyle factors, continued outperforming metropolitan areas, growing 0.6% versus 0.2% in capital cities.

Data and insights referenced from the CoreLogic Hedonic Home Value Index Report, April 2025.

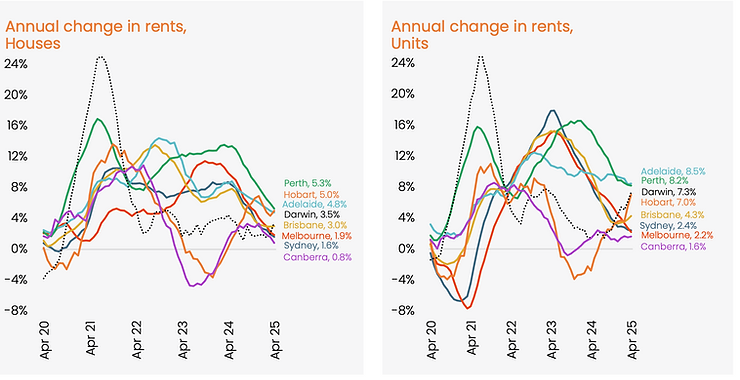

Rental Market Insights

- Rental growth slowed markedly, with annual national increases at 3.6%, a substantial reduction from 8.3% the previous year.

- Melbourne and Sydney, Australia’s largest rental markets, saw notable decelerations, with Melbourne’s annual rental growth easing to 2.0% and Sydney to just 1.9%. Perth maintained the strongest rental growth at 5.7%, reflecting ongoing economic growth in Western Australia.

Data and insights referenced from the CoreLogic Hedonic Home Value Index Report, April 2025.

Regional Resilience:

Outside the major urban centers, regional markets continue to demonstrate their resilience, with annual growth in some areas still slightly outpacing that of the capital cities. This highlights the ongoing appeal of regional living and the diverse dynamics within the Australian property landscape.

Underlying Forces Shaping the Market:

Several key factors are currently influencing the Australian property market:

- Interest Rates: The current RBA cash rate stands at 4.35%. The anticipation of further rate cuts, with a potential move expected as early as May 20th, could inject renewed vigor into borrowing capacity and market activity.

- Housing Supply: The chronic undersupply of housing, particularly in major cities, remains a fundamental driver of price growth, even amidst affordability concerns. While building approvals are projected to rise, the completion of new dwellings is expected to lag behind the required levels.

- Affordability: High property prices and stricter lending conditions continue to pose significant challenges for many aspiring homeowners, particularly first-time buyers.

- Population Growth: Strong population growth in recent years, especially in Queensland and Western Australia, has fueled housing demand. However, there are indications that this growth may be moderating in some regions.

- Government Policies: The upcoming federal election casts a shadow of potential policy changes related to housing affordability and supply. Proposed initiatives like tax-deductible owner-occupier loans for new properties and lower deposit schemes for first-time buyers could significantly impact market dynamics. The recent restrictions on foreign investors purchasing established dwellings also aim to improve housing availability for local property buyers.

- Economic Conditions: The underlying strength of the Australian economy and low unemployment provide a solid foundation for housing demand. However, global economic uncertainties warrant careful monitoring.

Expert Outlook:

The prevailing sentiment among real estate professionals suggests continued house price growth throughout 2025. This optimism is fueled by the expectation of improved affordability due to anticipated interest rate cuts, rising incomes, and the persistent issue of limited housing supply. Forecasts for national price growth in 2025 generally range from low to mid-single digits, with regional variations expected to persist.

More affordable markets like Adelaide and Perth are tipped to potentially outperform Sydney and Melbourne. Some analysts anticipate a more pronounced acceleration in price growth in the latter half of the year, aligning with the expected interest rate reductions.

The Australian property market in May 2025 presents a picture of steady but moderating growth. While price increases are still evident across the board, the pace has cooled slightly. The interplay of anticipated interest rate cuts, ongoing supply constraints, and the uncertainty surrounding the upcoming election will be crucial in shaping the market’s trajectory for the remainder of the year. Understanding these dynamics is essential for both current homeowners and those looking to enter the market in the months ahead.

If you’re planning to buy or sell property in today’s evolving market, now is the time to act. Whether you’re a first-time buyer, seasoned investor, or looking to make a strategic move, we’re here to guide you every step of the way. Contact us at Artier Property Group on 0481 830 090 to take advantage of expert insights, local knowledge, and tailored support to help you make informed real estate decisions in 2025.