Brisbane has quietly but powerfully emerged from the shadows of Sydney and Melbourne and proven itself as a property market heavyweight.

While the southern capitals tend to grab many of the headlines, Brisbane real estate has delivered solid, sustainable growth over the last few years, and it’s still going strong.

Now, with population surging, infrastructure booming, and the 2032 Olympic Games on the horizon, the River City is offering savvy property investors a rare mix of affordability, capital growth, and rental yield.

So, is Brisbane still a good place to invest in real estate in 2025?

What’s driving the Brisbane housing market?

Which types of property are primed for long-term growth?

In this article, we’ll unpack everything you need to know about investing in the Brisbane property market in 2025

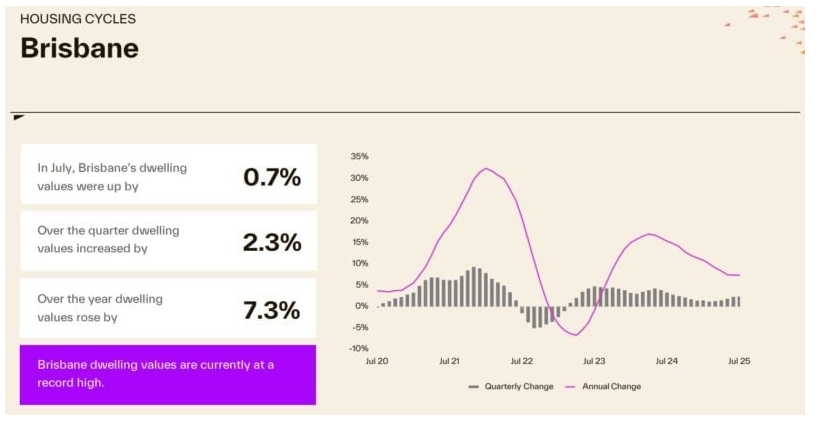

So far this year, Brisbane’s housing market is defying gravity.

Despite all the economic uncertainty and rising living costs, demand continues to outstrip supply, especially in desirable inner and middle-ring suburbs.

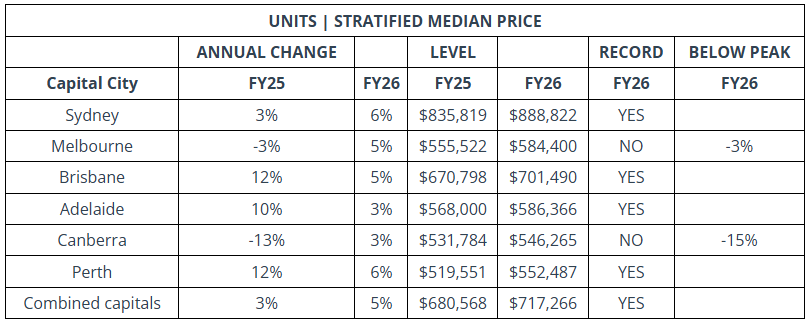

Brisbane apartments are performing extremely well, as shown in the table below, especially larger, owner-occupier style units.

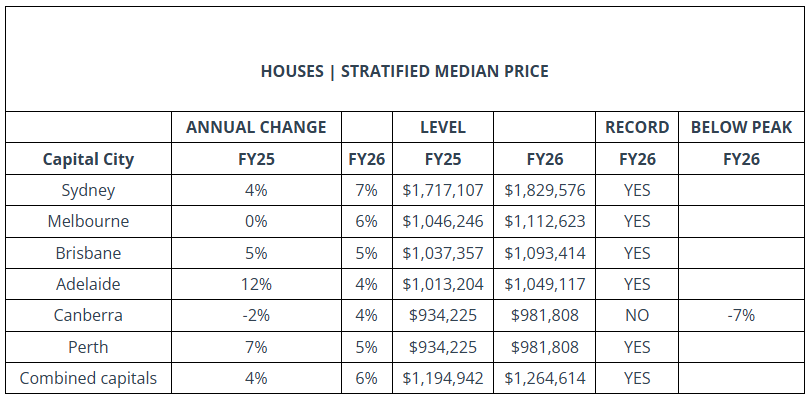

But it’s Brisbane’s detached housing market, particularly in lifestyle suburbs close to amenities and public transport, that continues to lead the way,

Here is the latest data on the median property prices for Brisbane.

| Property | Median price | MoM | QoQ | Annual |

|---|---|---|---|---|

| All Capital city dwellings | $949,583 | 1.20% | 3.00% | 7.90% |

| Capital city houses | $1,040,651 | 1.20% | 2.90% | 7.30% |

| Capital city units | $740,992 | 1.30% | 3.90% | 11.10% |

| Regional dwellings | $752,533 | 0.80% | 2.50% | 8.50 |

Here’s the forecast for Brisbane property prices in 2025-26

Domain’s latest reveals that Australia’s property market is expected to see continued price growth over the next 12 months, with Brisbane unit prices expected to moderate from the previously unsustainable double-digit growth, while house prices continue to grow at a pace similar to that of last year.

Domain’s House price forecasts

Domain’s Unit price forecasts

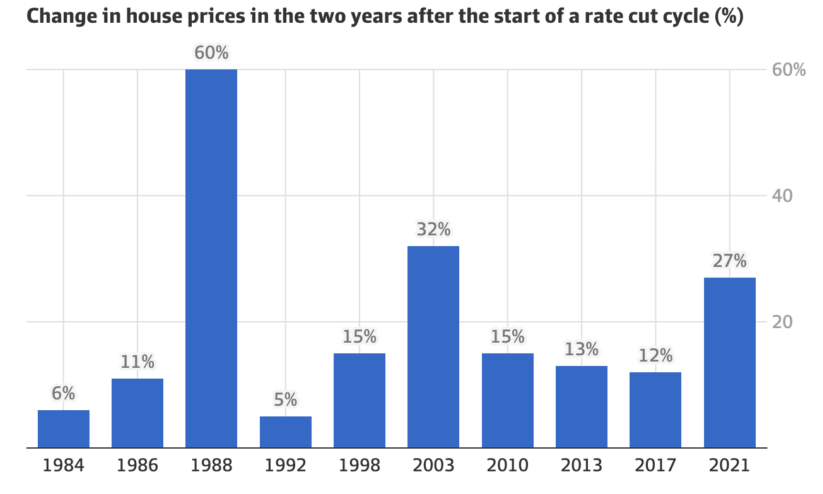

History suggests that once rates start falling, property prices don’t wait around.

Bank of Queensland chief economist Peter Munckton has crunched four decades of data, which was reported in the Financial Review, and said a 10 to 15 per cent price rise over the next two years is a reasonable bet – no matter how many cuts the RBA ends up delivering.

“There were smaller price rises in both the early 1980s and 1990s. But on both those occasions, the unemployment rate was above 10 per cent. Currently, the unemployment rate is within touching distance of 50-year lows.”

On the flip side, Munckton says the extraordinary 20 per cent-plus gains seen in the ’80s, ’00s, and during the pandemic also seem off the cards over the next couple of years

From January 1, 2026, virtually all first time home buyers will be able to enter the market with just a 5 per cent deposit, via a taxpayer-backed guarantee.

This is part of his election promise. Prime Minister Anthony Albanese promised to turbocharge the program by scrapping the $125,000 income cap, making it available to an unlimited number of applicants instead of just 35,000 per year, and dramatically raising property price thresholds.

A separate promise to build 100,000 new homes was also made – but that extra supply could take years to arrive, if it arrives at all.

Brisbane rents set to surge

Median apartment rents are likely to grow by 24% between 2025 and 2030 across Australian capital cities, according to the latest report by International Property Consultancy, CBRE.

CBRE estimates Brisbane apartment delivery to average 4,600 per annum over 2025-2030. Demand for housing stock (apartments and communities) is likely to average 16,000 p.a., which will drive down city-wide vacancy from 1.1% to 0.7%.

Over the next 10 years, demand for housing is expected to benefit from a triple boost: rising population (+4.1 million), rising jobs (+2.8 million), and rising income (+$39k).

CBRE estimates around $960 billion of additional income in the system to support mortgage, rent, and other living expenses.

Why Brisbane is Set to Keep Growing

Despite more homes being listed for sale and rising prices making property less affordable, the Brisbane property market is expected to keep steaming ahead in 2025.

A slowdown in construction has hampered the supply of new housing, concentrating buyer demand on existing properties.

But as interest rates keep falling throughout the year, buyer and seller sentiment will return to the market, and it is likely Brisbane will once again be one of the strongest performing housing markets in 2025.

At Artier Property Group, we’re finding that strategic investors and homebuyers are actively looking to upgrade, picking the eyes out of the market.

However, even when interest rates fall, affordability will remain an issue for many potential buyers who will only be able to pay up to the limit of what they can afford, so I would only invest in locations where wages are increasing faster than average and residents have multiple streams of income, not just wages.

This means investing in the more affluent inner-ring suburbs and the gentrifying middle-ring suburbs of Brisbane, which will outperform the cheaper suburbs, where residents will still find it difficult to afford to buy a home, and tenants are prepared to pay a premium to live in these locations.

Why Brisbane is Set to Keep Growing

1. Population Growth is Surging

Queensland continues to attract the lion’s share of interstate migration, with Brisbane absorbing much of the population inflow.

People are chasing lifestyle, affordability, and job opportunities—and that’s putting sustained pressure on housing demand.

2. Infrastructure Boom

Billions are being poured into infrastructure:

- Cross River Rail

- Brisbane Metro

- Queen’s Wharf development

- Major upgrades to road, transport, and health services

This isn’t just about short-term stimulus. It’s reshaping Brisbane’s accessibility and appeal, unlocking previously undervalued suburbs and supporting long-term growth.

3. Olympics 2032: A Decade of Opportunity

Hosting the Olympics will supercharge Brisbane’s global profile and catalyse further investment.

As we’ve seen in other host cities, this has a compounding effect on property values, infrastructure, and economic activity.

4. Affordability Advantage

Compared to Sydney and Melbourne, Brisbane remains significantly more affordable:

- Brisbane’s median house price is significantly lower than Melbourne’s

- Buyers and investors can enter the market with less capital, increasing competition in entry- to mid-tier suburbs

This affordability drawcard makes it appealing for both owner-occupiers and investors priced out elsewhere.

Best Brisbane Suburbs to Watch in 2025

Here are a few key areas with long-term growth potential:

Inner Ring

- Paddington, Red Hill, Highgate Hill – lifestyle, character homes, close to CBD

- New Farm, Teneriffe – prestige, river proximity, walkability

Middle Ring

- Tarragindi, Holland Park, Ashgrove – family-friendly, leafy, great schools

- Chermside West, Everton Park – strong value, infrastructure access

Growth Corridors

- Mitchelton, Nundah, Carina – gentrifying areas with community investment

- Woolloongabba – Olympic precinct uplift potential

Key trends for Brisbane’s housing market 2025.

Brisbane’s many infrastructure projects, including the Cross River Rail, Brisbane Metro, and preparations for the 2032 Olympics, are transforming the city.

Suburbs benefiting from these developments are likely to see increased demand and continued capital growth.

At the same time, Brisbane continues to attract residents from Sydney and Melbourne due to its more affordable housing, lifestyle advantages, and employment opportunities. This trend is driving demand in family-friendly and lifestyle-focused

Suburbs undergoing urban renewal and gentrification tend to outperform, as they attract a new demographic of more affluent residents (both owner occupiers and tenants), which in turn boosts demand for housing and rental properties.

Moving forward, there will be a flight to quality properties and an increased emphasis on livability.

That explains why we’re seeing robust demand for A-grade homes and investment-grade properties, particularly in lifestyle locations, with many holding their values well.

Buyers will be willing to pay a little more for properties with a little more space and security, but it won’t be just the property itself that will need to meet these newly evolved needs – a “livable” location will play a big part too.

To many, livability will mean a combination of:

- Proximity – to things like parks, shops, amenities, and good schools

Mobility – access to good public transport (even though this may be less important moving forward) or a good road system - Access to jobs

Another driver of strong capital growth in Brisbane is school zones.

As part of their property decision-making process, many parents and investors consider the geographical location of a potential property in relation to a school catchment zone.

When people are looking for a home, they’re looking for a lifestyle, and education is a big part of that picture.

Brisbane’s fundamentals are very strong

It’s not just Brisbane’s population and migration growth that is holding up the state’s economy; the remainder of the city’s underlying fundamentals are also very strong.

CommSec’s State of the States report assesses economic performance across Australia and shows that on an aggregate basis, our resources-focused states Queensland and Western Australia both have the strongest annual economic momentum, supported by robust housing markets and solid population growth.

Queensland is now in first spot with Western Australia slipping to second.

There is little to separate the commodities and tourism-heavy states, with Queensland ranked first or second on five of the eight key economic indicators.

While Brisbane’s property market was significantly more affordable before the recent property boom, it still represents a valuable benefit to buyers who are looking to purchase at a time when interest rates are falling and we move into the next phase of the property cycle.

And the impending 2032 Olympics, hosted by Brisbane, will only serve to put even more pressure on the city.

The need for upgraded infrastructure and transport in Brisbane, the Gold Coast, and the Sunshine Coast will likely put a rocket under Brisbane’s property market.

Why?

Because infrastructure spending is one of the most powerful forces in residential real estate, it can transform local economies and generate real estate booms.

That’s because major infrastructure projects can elevate the appeal of locations by improving the accessibility or amenity of an area, and they can also generate economic activity and jobs during construction.

The Brisbane property market continues to offer compelling investment opportunities, but only for those who take a strategic, research-backed approach.

With strong population growth, infrastructure investment, rising rental demand, and the Olympics ahead, Brisbane has all the ingredients for sustained capital growth and wealth creation.

But success won’t come from following the herd or buying in hype-driven locations.

It will come from careful selection, long-term vision, and expert advice.

Ready to Invest in Brisbane?

If you’re looking to grow your wealth safely and strategically, now’s the time to talk to the team at Artier Property Group.

Our Brisbane-based property buyer’s agents and property strategists understand this market inside out, and we’re here to help you make the right move.